Chapter 6: From Silos to a Cross-functional Focus on Customer Experience

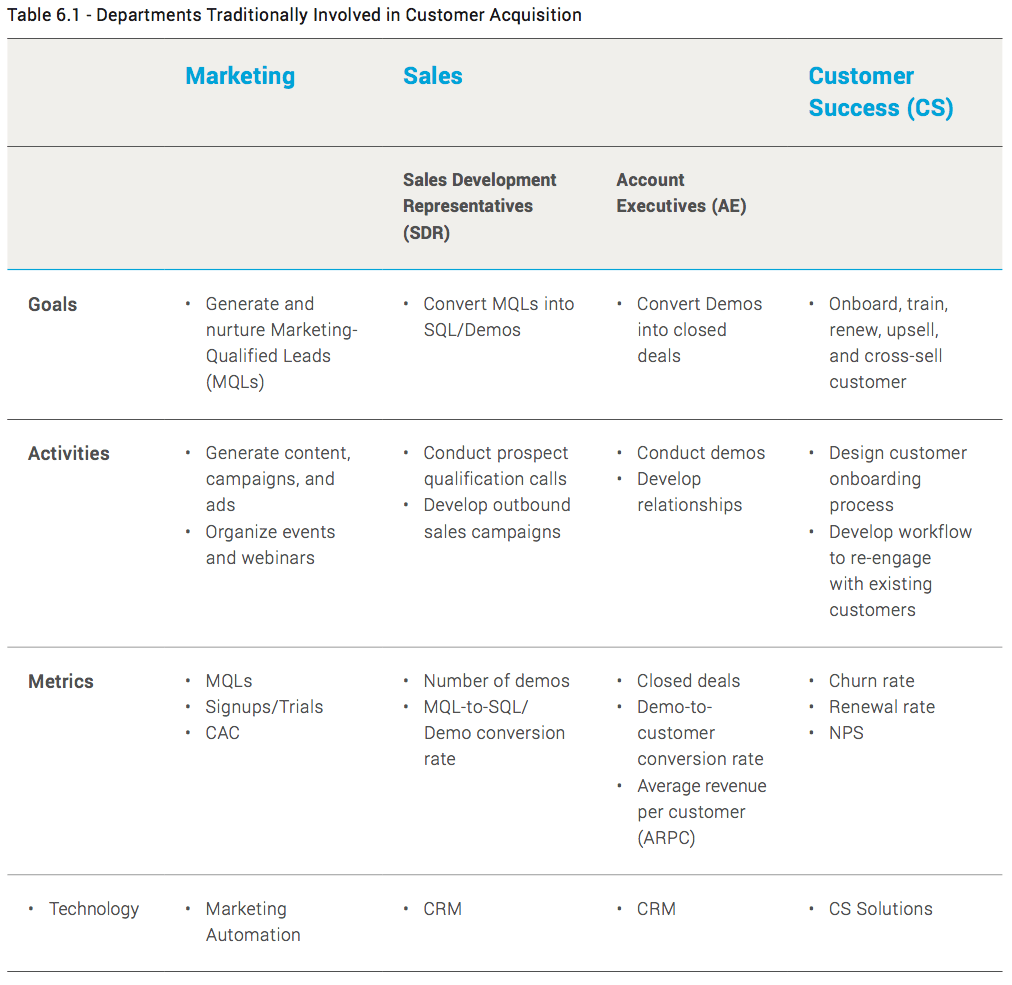

As we touched upon earlier in the book, the customer acquisition process in the on-premise and early SaaS eras was predominately sales-driven. Sales teams were primarily responsible for driving revenue. As information about products became more available, companies started bringing marketing closer to sales in order to close the gap between prospect exposure to content and messages, and nurturing them to be sales-ready. Marketing was responsible for driving the content strategy and campaigns to generate and nurture leads, and the sales organization was divided into three branches: sales development representatives (SDRs), responsible for qualifying prospects; account executives, responsible for closing deals; and customer success, responsible for keeping the customer long-term. The last of the three branches, customer success, became a department of its own.

In many organizations, that means enterprise buyers are interacting with three or four departments, depending on whether you consider SDRs to be a separate group. Each department sends its own e-mails and manages prospect interactions, making it difficult to keep track of the overall customer experience.

To deliver a stellar customer experience, companies have to rethink how departments collaborate. The first step in understanding the customer experience is to change from a sales process perspective to a buyer process perspective. Companies that understand the buying process from the customer’s perspective are better positioned to develop great customer experiences.

Customer lifecycle thinking helps teams and departments understand and respond to how prospects and customers buy.

Let’s be clear: Customer lifecycle is about understanding the buying process from the perspective of the customer, rather than a sales process from the perspective of the seller. It’s a very important distinction, because when organizations focus on the buying processes, it forces them to carefully examine a customer’s journey. Customer lifecycle bubbles up critical questions, like:

- Why do customers and organizations buy what they buy?

- How do they buy?

Unfortunately, many companies are still organized around a GTM and sales process that results in disconnected from customer experiences. Just as on-premise and early SaaS companies did, most of today’s SaaS companies divide their complex GTM/sales process among specialized departments — marketing, sales, and customer success.

Traditionally, marketing is responsible for generating awareness and interest in the form of leads. Lead nurturing also falls under marketing. Sales teams close deals, and customer success oversees the customer onboarding process post-transaction, ensuring customer satisfaction, which ultimately is measured by retention and churn rates.

6.1 The Traditional Customer Handoff is Ineffective

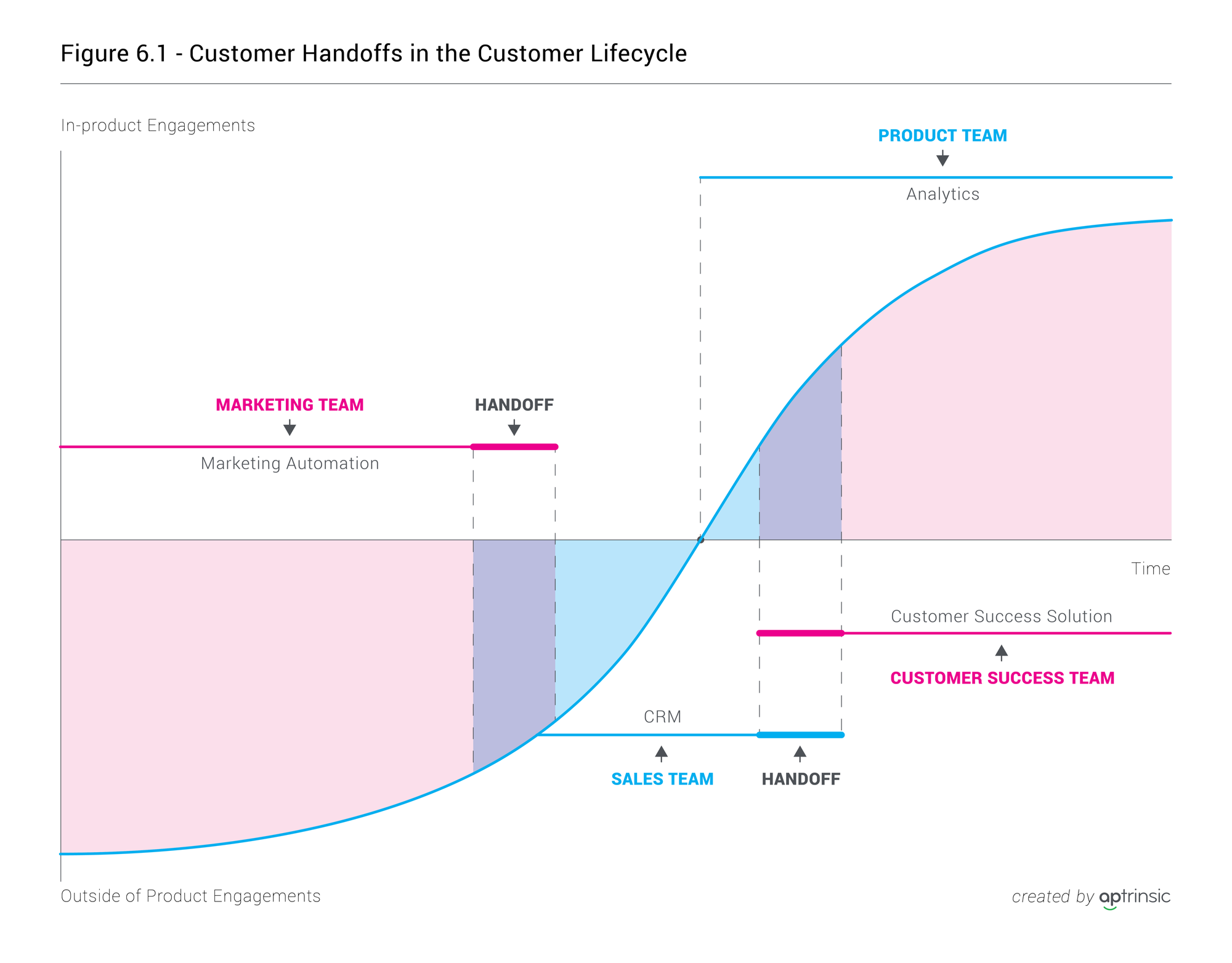

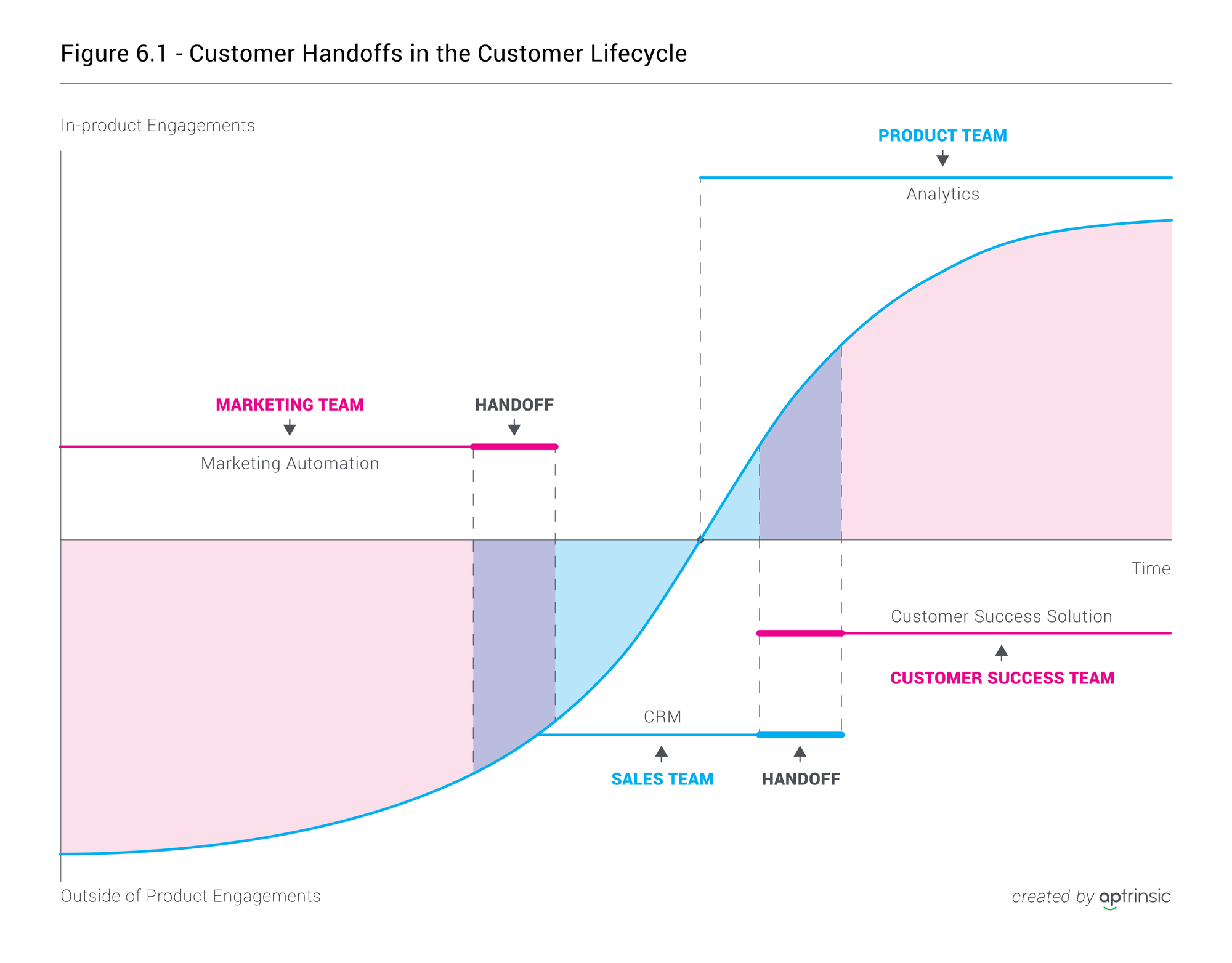

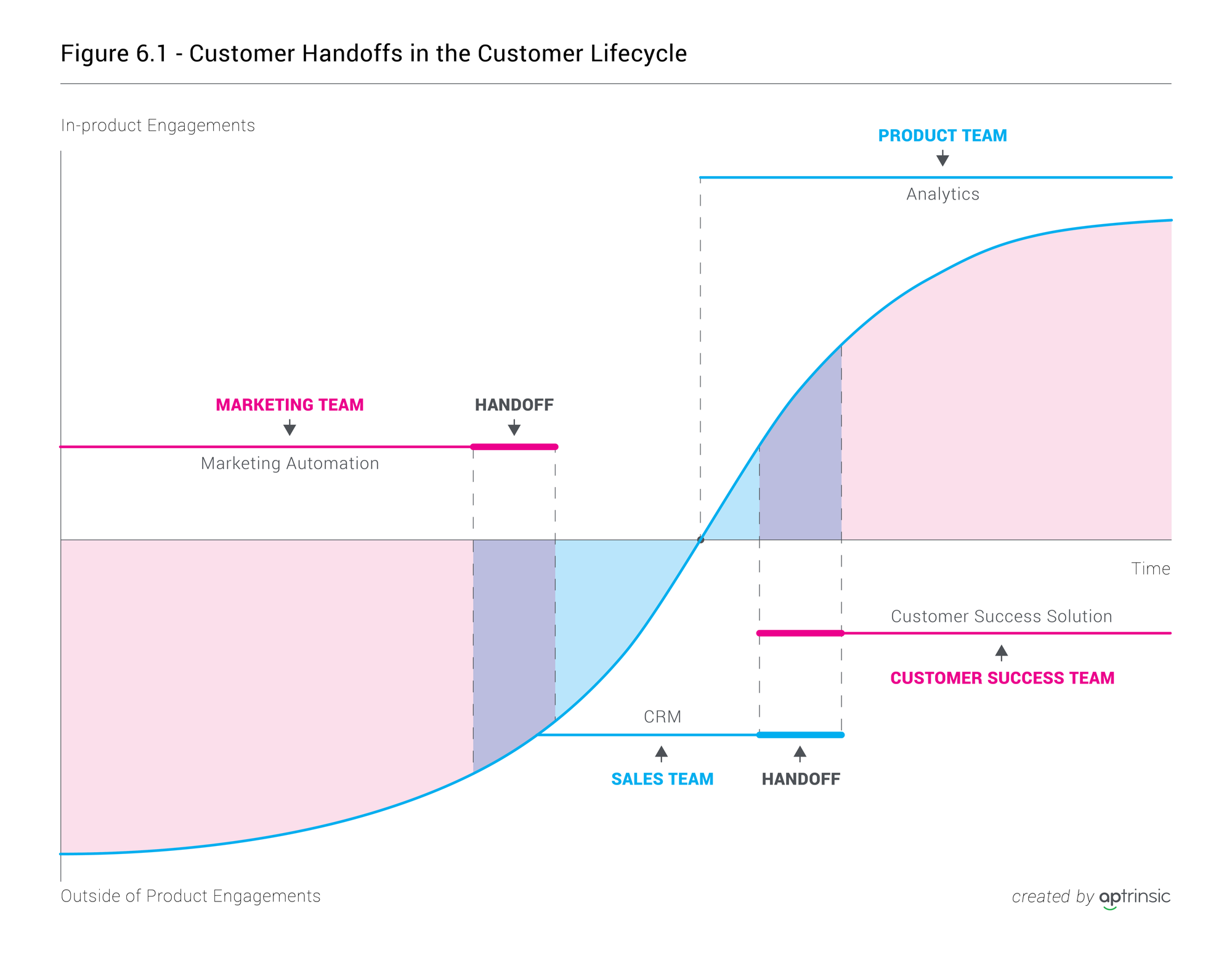

Figure 6.1 shows that each team is responsible for only part of the customer lifecycle. A prospective customer is passed from one department to another. Marketing views the prospect as a lead and passes it to the Sales Development Representative (SDR) team. An SDR qualifies a prospect and hands it off to the account executive (AE) for demo and closing. The AE sends newly signed customers to the customer success team, which is responsible for keeping the customer happy. No wonder it can be tricky monitoring and managing overall customer experiences with the company and product!

When a company experiences high customer churn rates, the first inclination is to look at what’s wrong in the customer success department. Rarely does an organization look into marketing and sales to evaluate how these teams acquire customers and communicate with them, and how they impact customer expectations and behavior. Some questions to consider:

- Does your marketing team target the right customers and communicate appropriate value?

- Does your sales team qualify and close the right customers without overpromising?

Further, each department has goals and incentives that are aligned only with the part of the customer lifecycle for which they are responsible. The marketing team is incentivized based on leads; sales is based on demos and closed deals; customer success on churn rate and renewals. A sole focus on department goals can cause a disjointed customer experience when, for example, a customer receives multiple e-mails — from marketing telling them about an upcoming webinar, from the customer success team notifying them about their upcoming renewal, and from the product team informing them about a new feature release.

On top of that, each department is likely to use its own technology to send customer communications. This adds to the issue of a broken customer experience, since integration between the systems is often poor or non-existent.

The goals and incentives of each functional team should be considered based on how it impacts the overall customer experience and CLV. In his book Sales Acceleration Formula, Mark Roberge explains how Hubspot changed sales compensation plans to address a growing customer churn rate1. This is the first and critical step of sales and customer success teams: sharing responsibility for CLV and churn rate. But what about product and marketing teams? Should they be responsible for these metrics as well? We think so.

6.2 Why Aren’t Product Teams More Involved in the Customer Acquisition Process?

Just as marketers in SaaS were brought closer to sales and made increasingly more responsible for revenue-related metrics2, product managers will have to become part of the customer acquisition process. Unfortunately, in most organizations, product teams are not part of the process. When the product team is removed from the customer acquisition process, product analytics and customer behavioral data are missing from consideration to guide customers through lifecycle stages. Additionally, how does the organization know if the product is causing a customer acquisition problem? How long does it take for the marketing, sales, and customer success teams to determine and convince the broader organization that the product might be the cause of a failing customer acquisition strategy?

The disconnect between product teams and other key customer-facing teams (marketing, sales, and customer support) is similar to the long-standing disconnect between marketing and sales. At the end of the day, every department in a customer-focused organization should be involved in relevant customer-related activities. In the case of product teams, this means making them an integral part of customer acquisition tactical planning and execution.

Product experiences are an essential part of the customer experience. That’s why product leaders need to understand the buying process, and what features are driving the value and adoption. In some organizations, product leaders are tasked with the goal of increasing average selling price (ASP). Specifically, they must decide which product features will be valued higher and could increase ASP.

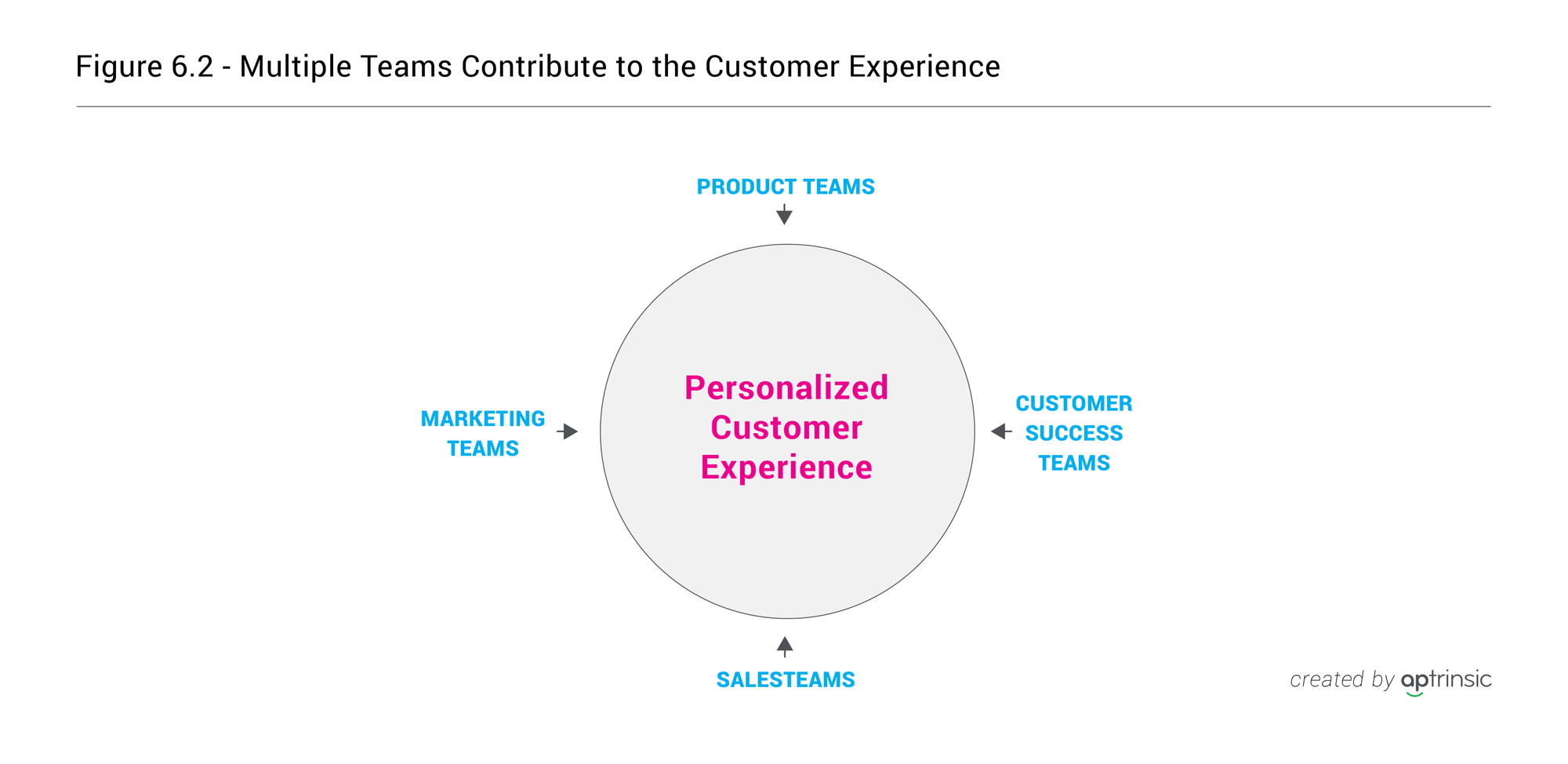

Undoubtedly, the marketing, sales, customer success, and product teams should all be responsible for the customer experience. It is not easy to do. The key is for organizations to align goals and metrics around the customer experience across departments. Then they must find a way to aggregate customer data across multiple technologies. By taking these steps, they will be in a better position to design personalized customer engagements.

6.3 Unified Customer Profile Data is Essential to Stellar Customer Experiences

The siloed organization is only one reason why creating a great customer experience is difficult for most organizations. This isn’t a new problem, but it has a serious effect.

Historically, enterprise software vendors structured solutions to target a particular department and decision-maker, so each department relied on its own primary software solution to help manage workflows. This only reinforces the silos. Not only are departments driven by different goals and incentives, they often use different systems to manage and track customer interactions and relationships.

Marketing teams work with marketing automation tools; sales teams rely heavily on CRM systems; and customer success teams now call upon their own category of products to manage accounts and predict customer segments that are at risk of churning.

To be successful at providing a personalized customer experience, your organization needs a single system of record for all customer profile, company, and behavioral data. However, aggregating this data can be a very complicated process. Even if your company manages to piece all the relevant data together, it’s rarely the case that product usage data can be attributed to an individual customer. New solutions (e.g. Zapier and Segment), which help companies connect APIs between different tools, can be useful. However, these API solutions are not robust enough to fully solve this problem, and instead create a “shadow IT”3 effect as departments and individuals find their own workarounds to get their jobs done. And the challenges do not end here. In-product customer behavior data is difficult to access and align with customer production data and account data that lives in the CRM system.

Wondering if your organization is suffering because of these issues? Ask yourself these questions:

- How often do your top 20 percent of customers, based on annual contract, log in to your product?

- What are the top in-product journeys for these customers, from adoption to expansion?

- What are the top three features that these customers use?

- How quickly can you design messages to engage a customer or showcase your new features?

- What features cause customers to stop using the product?

- Where in the top three customer journeys are your prospects and clients getting stuck?

If you can’t answer these questions, you don’t have the holistic view you need of a customer’s interactions across departments, or a whole picture of their product usage.

Historically, CRM systems are the default customer data warehouse. But CRMs weren’t designed to enable teams to build multi-channel customer engagement based on the comprehensive customer profile data that includes in-product behavioral data.

A product analytics solution can help teams understand how users engage with the product, but these solutions are often missing the customer engagement piece — or worse, they can’t really connect in-product behavioral data with account data (subscription details, customer lifecycle stage) and profile data (name, title).

Organizations need a unified, 360-degree collection of data, generated by prospects and customers while using the product, that can serve as a single source of truth.

Unified customer data should include these details:

- Profile data: name, title, contact information

- Company data (a.k.a. firmographics): size, subscription level, support tickets for all organizations and regions

- Behavioral data: daily/monthly active users, number of logins over a period of time, number of completed core use cases, number of features interacted with

To align departments around the customer lifecycle and customer experiences, companies need to bring product teams closer to the customer and the customer acquisition process. This unified data is a critical step.

6.4 From Department Goals to Customer-Centric Goals

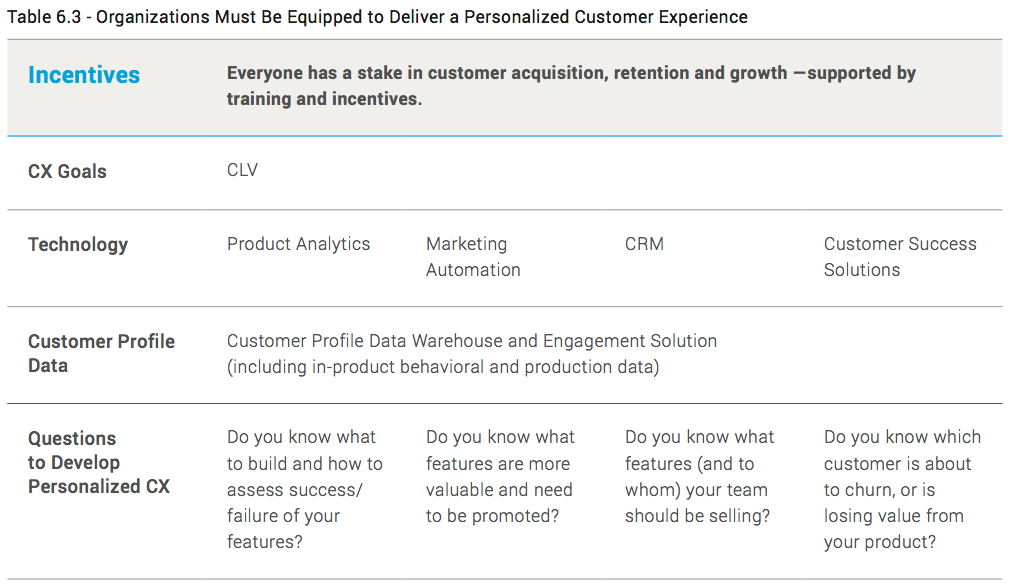

In addition, organizations must align marketing, sales, customer success, and product teams on how to design and deliver effective customer experiences.

The first step is to tie customer experience metrics to the core objectives and goals of each department. CLV is one of the best metrics to measure and evaluate the long-term health of customer relationships. Net Promoter Score (NPS) is another metric that measures customer satisfaction and how customers value the experience with your product and company.

For example, marketing teams not only need to drive awareness via product trials and signups, but also track if prospects are becoming high-value customers. Revenue is a primary goal for sales teams, but CLV should also be used to evaluate the team’s performance.

That’s why metrics that measure the health of customer relationships, such as CLV, should also be connected to incentives. As a guide, look at how Hubspot changed its sales compensation plan to reflect CLV.

Bottom line: We believe the product department should be involved in the customer acquisition process, and we believe every department involved in that should connect their goals, objectives, and incentives to CLV as a primary metric to evaluate long-term customer experience and satisfaction. We will discuss this topic in more detail in a later chapter.

Table 6.1 summarizes the metrics each department traditionally tracks throughout the customer acquisition process.

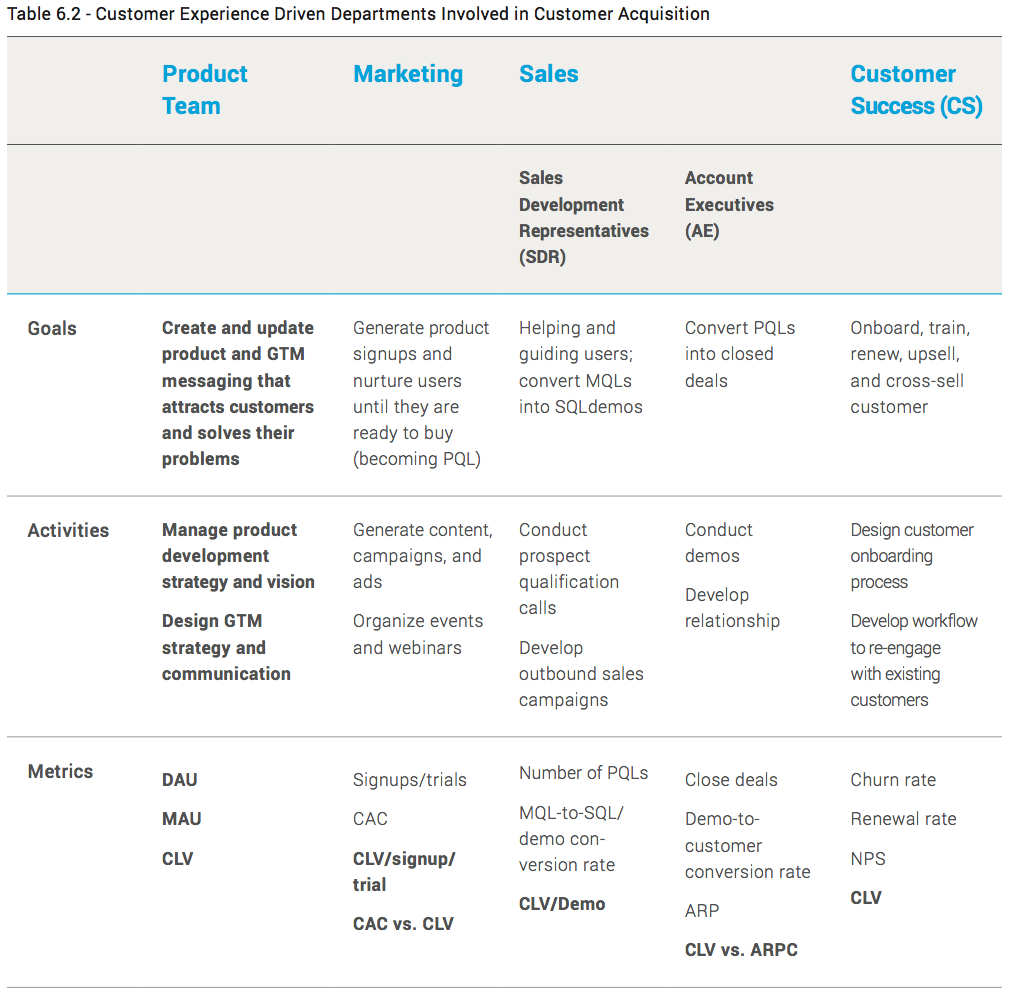

As you probably noticed, the product team is missing from this equation. In Table 6.2, below, we’ve added the product team to show how its goals, activities, and metrics fit with the whole customer acquisition process. You’ll see a metric referred to as PQL. That’s a Product-Qualified Lead. We’ll explore this in more detail later in this chapter. For now, know that it’s defined as a prospect that signed up and demonstrated buying intent based on product interest, usage, and behavioral data. Note also that SDRs shift from simply converting MQLs to helping and guiding users. This is an important distinction, and critical to success in the product-led, customer experience era.

How does this all relate to a personalized customer experience? It’s about creating alignment and insight to meet and exceed customer expectations.

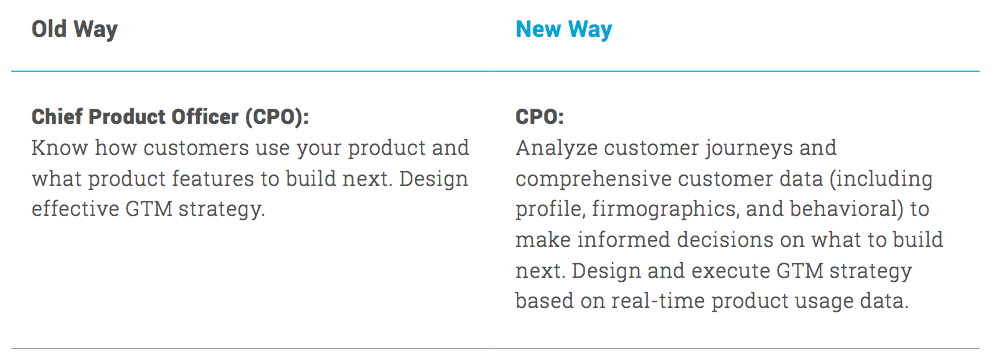

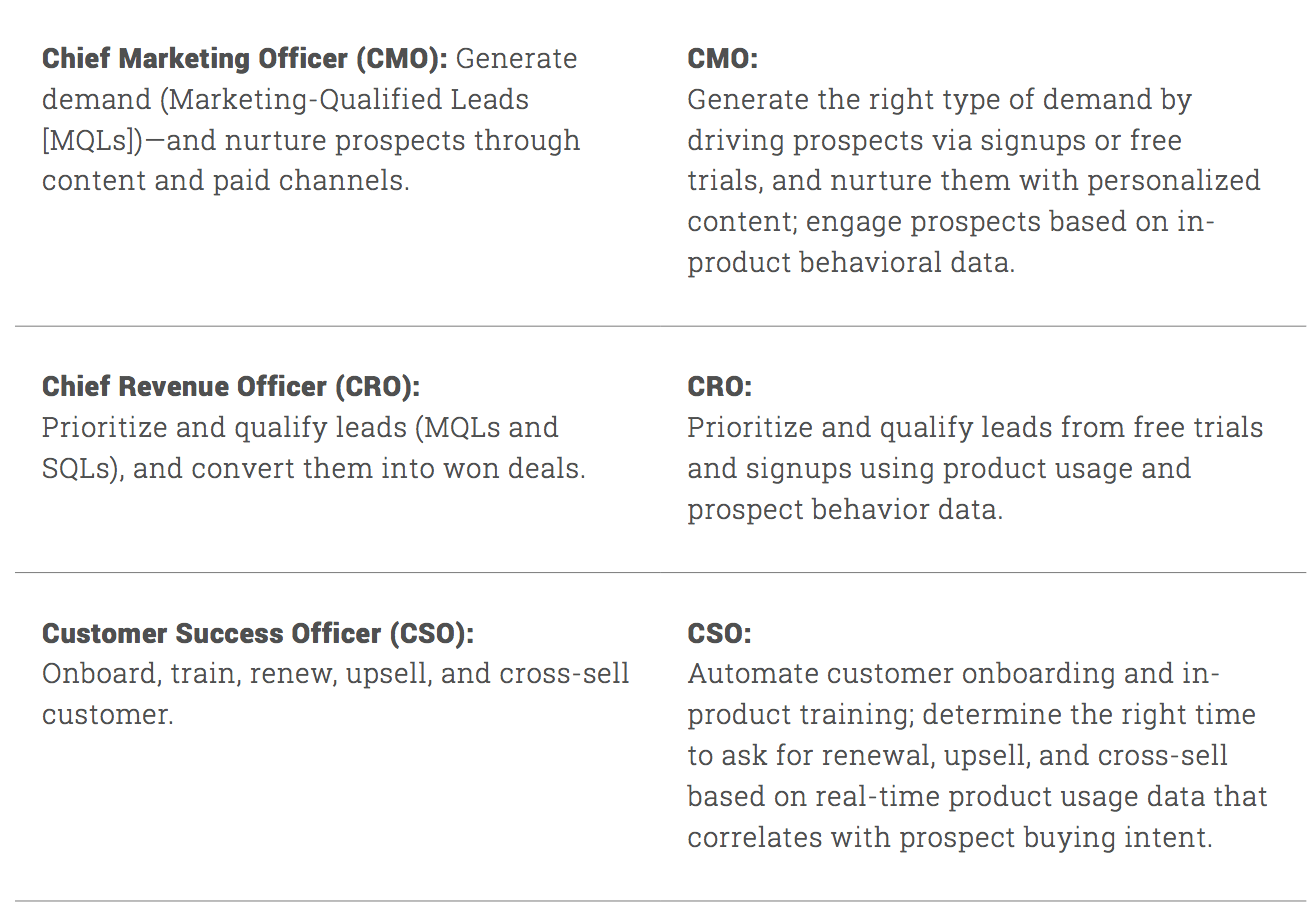

When department goals and objectives are aligned around customer experience metrics, needs and vision, and unified customer profile data combining in-product behavioral, profile, and company data, cross-functional teams can create and deliver personalized customer experiences. Let’s look at how team goals are changing, and how C-level executives are adjusting:

6.5 Key Takeaways

- Customer lifecycle enables companies to focus on the buying process from the customer’s point of view rather than from the sales process standpoint.

- Siloed departments make it difficult to design seamless customer experiences.

- Product teams need to be more active in the customer acquisition process and overall customer lifecycle.

- Aggregating customer data across many technologies, managed by different departments, is challenging. Production data and in-product customer behavioral data are essential to creating a unified customer profile view.

- Insufficient customer data is only part of the problem. Companies need tools to create personalized engagement based on timely access to customer data collected across multiple channels.

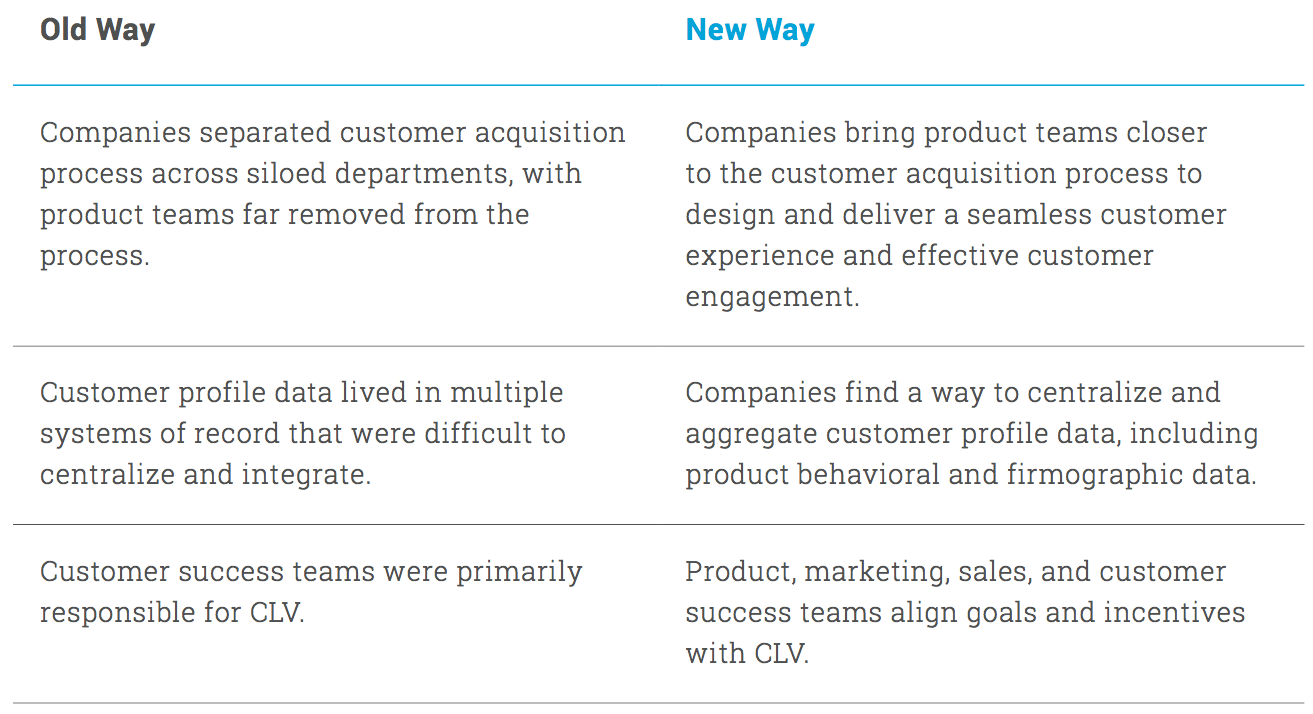

Here’s a quick comparison of old vs. new ways to operate.